In the previous issue of the CBAM series, we introduced the significance of CBAM, the timeline for its operation, and the control requirements. We addressed fundamental questions such as which enterprises need to report CBAM, who should submit the CBAM data, and to whom. We also discussed some challenges in the reporting process, including difficulties in collecting massive amounts of data, dealing with numerous forms, and the complexity of carbon calculations.

As the first reporting deadline within the transition period approaches, leaving Chinese exporters with only one week, this article will continue to explore how to quickly complete CBAM reporting and provide a guide to reporting strategies.

PART.01 CBAM Reporting Schedule and Its Urgency

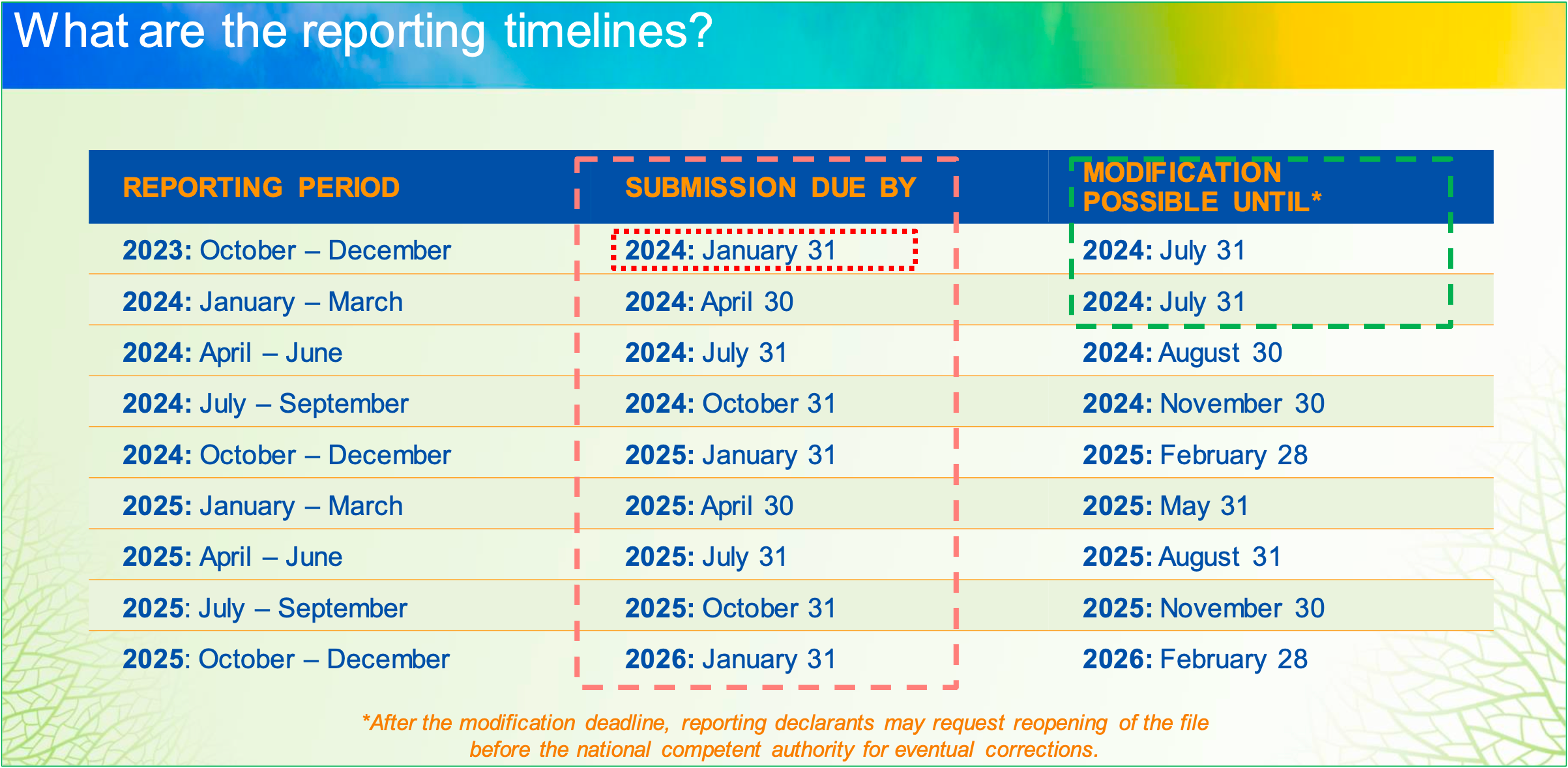

From October 1, 2023, to December 31, 2025, is the transition period after the formal implementation of CBAM. During this period, declarants are required to submit CBAM reports quarterly. Failure to report as specified or to submit on time will result in penalties for "incomplete declaration" or "failure to declare on schedule," amounting to fines of 50-100 euros per ton of emissions.

As illustrated below, January 31, 2024, marks the first reporting deadline of the transition period. Typically, CBAM declarants are the importers of CBAM goods or their indirectly appointed customs representatives. However, declarants often request exporters (representatives of Chinese enterprises exporting CBAM goods) to complete CBAM forms for the corresponding products. EU importers usually reserve about a week to check data quality, requiring Chinese exporters to complete the relevant data reporting one week in advance. Therefore, Chinese exporters are left with only one week for reporting.

Source: CBAM

PART.02 How to Quickly Complete Carbon Data Reporting for CBAM?

Although the forms required by the EU for reporting are complex, the most crucial data consists of the basic information of the goods and carbon emission data. The former is relatively easy for companies to collect and compile, while the most central and challenging aspect is the carbon emission data.

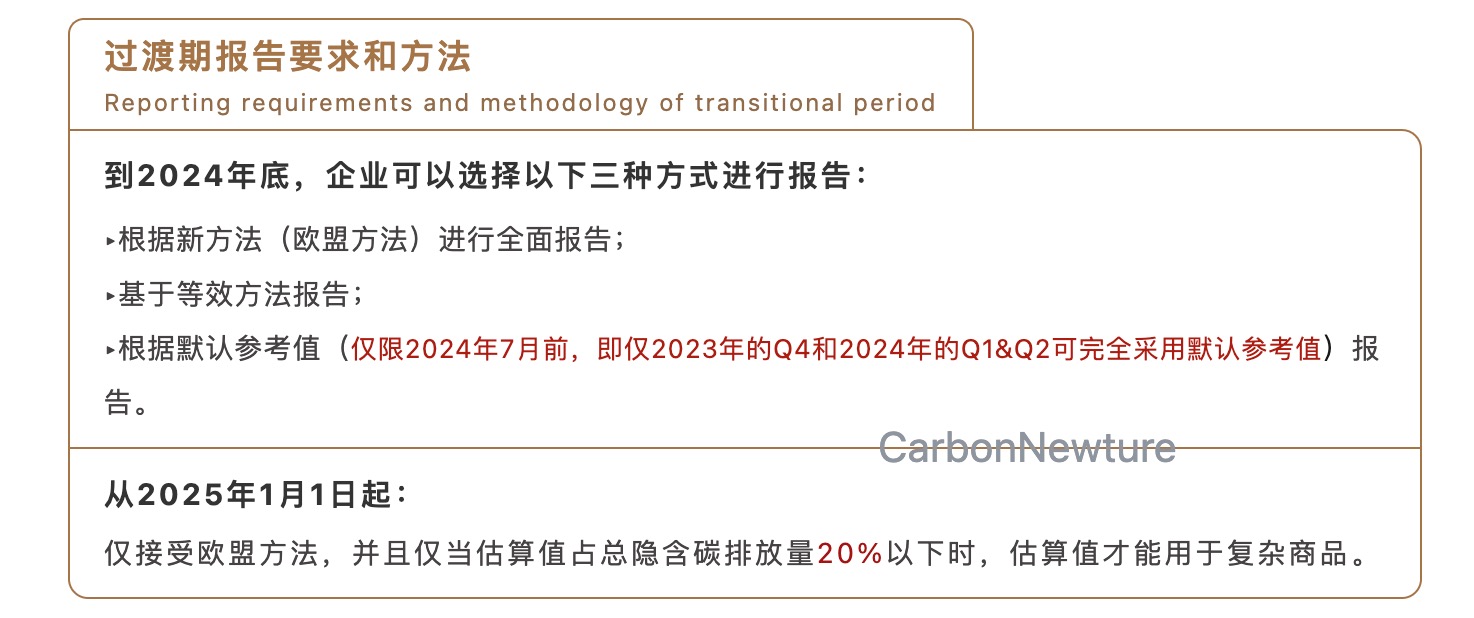

During the transition period, CBAM officials have provided a certain degree of flexibility in the calculation methods for the carbon emission data of CBAM goods, as shown below:

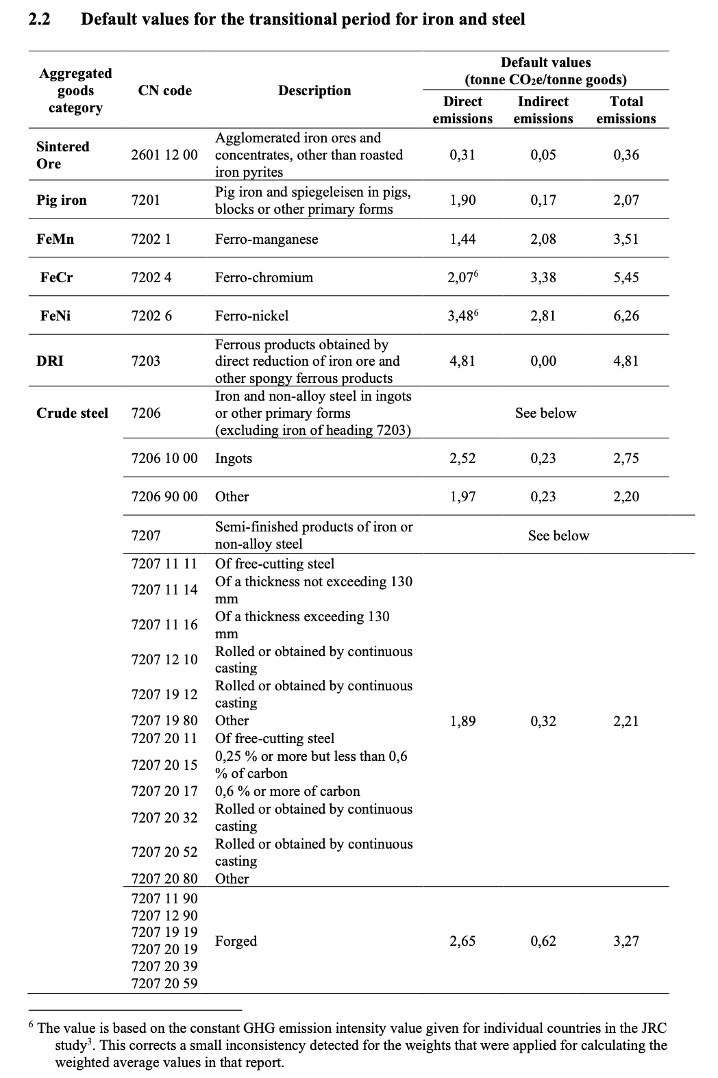

In simple terms, for the initial reporting, we can use the three methods mentioned above to calculate the carbon emissions of CBAM goods. Among them, the method of estimation based on default reference values (also known as "default values" domestically) is relatively simple and quick. The European Commission has already released default reference values (partial steel default values shown in the figure below, and you can contact us for the complete list of CBAM default values). Exporters can quickly complete the initial reporting based on these default reference values. It's important to note that until July 2024, CBAM reporting can entirely rely on the reference values provided by the EU to estimate carbon emissions.

Source: CBAM

In summary, in CBAM reporting, Chinese exporters need targeted and specialized guidance to avoid economic penalties resulting from a lack of understanding of carbon calculations and reporting methods.

PART.03 CBAM Reporting Strategy Guide

However, relying solely on default reference values to report carbon emission data is both a shortcut and a potential pitfall. If the reporting for the first two quarters exclusively utilizes default reference values for carbon emission calculations, without organizing internal enterprise data or tracing emissions data upstream, it becomes challenging to establish a foundation for CBAM reporting after July 2024 (as mentioned earlier, complete reporting with default values is not allowed after July 2024. Additionally, using default values for calculations may result in carbon emission data exceeding actual emissions, potentially leading to higher carbon tax payments for the company in the future).

Furthermore, to ensure the subsequent reporting data quality meets EU requirements, the completed reports from the earlier stages might need to be "reworked" or revised. This could perhaps be the reason why the EU allows declarants to make corrections to reports submitted for the first two quarters until July 31, 2024.

Therefore, it is recommended that businesses adopt three reporting strategies based on their own situations.

🔹 For companies that have not made any preparation for reporting, using default reference values (default values) for reporting is advisable to ensure timely completion and avoid penalties.

🔹 For companies with some data foundation but have not yet initiated the collection of carbon emission data, a strategy of "largely using default values + partially using actual values" can be employed for reporting. Internal data can use actual values, while default reference values can be applied to emissions from precursor materials temporarily untraceable.

🔹 For companies with a solid data foundation, it is recommended to use actual production data for over 80% of the product's lifecycle, with the remainder (not exceeding 20% of the total implied carbon emissions) using default reference values or estimates for data that cannot be accurately obtained.

In summary, businesses should promptly conduct internal carbon data collection reviews and communicate with suppliers to ensure the smooth reporting of carbon data for CBAM goods.

Reference:

https://mp.weixin.qq.com/s/RGJnJhVMiuKq69W0QE50Ig